fire.com

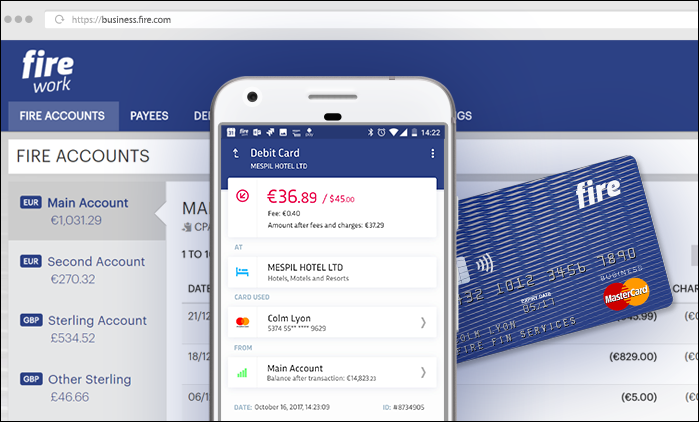

Digital accounts for businesses

fire.com helps businesses to manage payments with digital accounts and debit cards that support a range of payment services. Their mission is to make digital accounts easy to open, safe and accessible for businesses at every growth stage.

With fire.com you can

Create - Instantly open all the current accounts you need

Access - Pay and get paid using a host of payment services

Control - Stay in control with the fire.com mobile and web apps

Build - Use the fire.com API to integrate with third-party systems

Trust - Gain peace of mind, knowing they are regulated and built to the highest standards

Access - Pay and get paid using a host of payment services

Control - Stay in control with the fire.com mobile and web apps

Build - Use the fire.com API to integrate with third-party systems

Trust - Gain peace of mind, knowing they are regulated and built to the highest standards

Payment Services

A fire.com account provides businesses with access to a range of real-time and competitive payment services including:

Sterling and Euro Accounts - Open as many fire.com accounts as you need to manage payments and simplify reconciliation. Every fire.com account has its own unique details – sort code and account numbers for sterling accounts and IBANs for euro accounts.

Bank Transfers - With fire.com you can pay and get paid by bank transfers to and from any bank account in the UK or Eurozone. If you’re selling in sterling and euro, a fire.com account is ideal for managing payments in both currencies.

Debit Cards - Order as many debit cards as you need. You can link your fire.com debit cards to any of your fire.com accounts and use your card to pay instore, shop online or take out cash from an ATM.

A fire.com debit card is linked to both a sterling and euro account, so you automatically pay from your sterling account when transacting in sterling and from your euro account when paying in euro, avoiding unnecessary bank fees.

FX Transfers - Instantly transfer funds between your Fire euro and sterling accounts at any time. The FX rate and fee are displayed before a transaction is executed so you know exactly what you’re getting. Funds are immediately available and you can make real-time FX transfers between your fire.com accounts 24×7, 365 days a year.

fire.com API - To automate large volumes of payments use Fire API to integrate your internal business systems or applications directly to your fire.com accounts. All payments initiated via the fire.com API are securely authorised via the firework mobile app, assuring you of the highest control standards.

Accounting Compatibility – Fire provides statements compatible with major online accounting packages, enabling you to download account statements in industry standard OFX format for importing into Xero, FreeAgent, QuickBooks, Sage One and many others.

Direct Debits - Direct debits are available with Fire sterling accounts but not currently available with euro accounts. This enables you to easily and conveniently pay from your fire.com sterling accounts by Direct Debit.

Payment Requests - Payment Requests are a simple way to get paid by Fire personal users. As a business you can create a Fire Payment Request and share it via URL or QR code across any media – online web/mobile site, in app, email, message or print.

Eligibility

To be eligible for a fire.com business account you must be a Sole Trader or a Limited Company, registered in the UK or Ireland. Directors may be based out of these areas in some instances. If invited to sign up, you will be required to prove your identity and nature of business with supporting documentation. Once approved, fire.com will aim to have your business account set up within 48 hours. There is no set-up cost and you only pay as you transact. View the fire.com business account fees here.

Ready to get started? Fill out our quick online form to register for a fire.com account today.