Cobia Accounting

1 Month Free

1 Month Free

Say goodbye to spreadsheets and hello to automation

Cobia offers:

✔ Bookkeeping

✔ Expense Claims

✔ Payroll

✔ VAT and PAYE

✔ Corporation Tax

✔ HMRC Management

✔ Accounting Queries

✔ Dividend Management

✔ Bookkeeping

✔ Expense Claims

✔ Payroll

✔ VAT and PAYE

✔ Corporation Tax

✔ HMRC Management

✔ Accounting Queries

✔ Dividend Management

1 Month Free - Worth £99!

Sign up for 1 month free accounting service with Cobia Accounting

Choosing the right accountant for your new business is one of the most important decisions you will ever have to make as a business owner.

Your accountant is one of the few people who gets to see the inside-out, behind-the-scenes structure of your business. They are the closest person to your financial, tax and payroll data as anyone can possibly be.

In some sense, it can feel a bit like taking on a business partner.

Your accountant is one of the few people who gets to see the inside-out, behind-the-scenes structure of your business. They are the closest person to your financial, tax and payroll data as anyone can possibly be.

In some sense, it can feel a bit like taking on a business partner.

Small business owners often overlook the magnitude of time that is involved in properly maintaining their accounts. In some cases, business owners can be guilty of thinking that by handling their own accounts this is an effective means to save money and keep costs down. And while it makes perfect business sense to cut costs and save money, scrimping on accounting services is not the way to do it. Hiring an accountant should be viewed as an investment rather than an expense.

Keep in mind, your accountant can be more than just the person who monitors and accurately records all your financial and tax transactions. A good accountant is also there to help advise you on the most effective ways to plan your finances and taxes in order to grow your business. Not to mention, they can also advise you on the legal side of your finances, too.

Accounting errors can prove to be costly to any company, let alone a small business just starting out, which could face devastating consequences if they mess up your numbers.

Unfortunately, it is now easier than ever to create a website and start a business from home, and the rise of the unqualified accountant is a problem.

It’s no secret that small business owners often make mistakes in their early years due to the lack of proper accounting procedures or through hiring unqualified people to maintain their financial records.

Thankfully for you, we can help you avoid any of these costly mistakes and we can help you pick an accounting service which is the perfect fit for your business. We have partnered up with Cobia Accountants to provide you with expert professional advice and cost-effective accounting services, including VAT registration with HM Revenue & Customs (HMRC) and the use of Xero software to ensure all your Making Tax Digital obligations are met.

Keep in mind, your accountant can be more than just the person who monitors and accurately records all your financial and tax transactions. A good accountant is also there to help advise you on the most effective ways to plan your finances and taxes in order to grow your business. Not to mention, they can also advise you on the legal side of your finances, too.

Accounting errors can prove to be costly to any company, let alone a small business just starting out, which could face devastating consequences if they mess up your numbers.

Unfortunately, it is now easier than ever to create a website and start a business from home, and the rise of the unqualified accountant is a problem.

It’s no secret that small business owners often make mistakes in their early years due to the lack of proper accounting procedures or through hiring unqualified people to maintain their financial records.

Thankfully for you, we can help you avoid any of these costly mistakes and we can help you pick an accounting service which is the perfect fit for your business. We have partnered up with Cobia Accountants to provide you with expert professional advice and cost-effective accounting services, including VAT registration with HM Revenue & Customs (HMRC) and the use of Xero software to ensure all your Making Tax Digital obligations are met.

What Cobia Will Do For You

For a fixed monthly fee, Cobia will take care of all your accounting needs, including:

Accounting Software: Cobia provide, for free, the accounting software from Xero. The system can be connected to your bank account to allow all transactions to be uploaded in real time, as you make them.

Bookkeeping: All transactions need accounting for in the correct categories so they are ready for your annual account submissions or quarterly VAT returns.

Annual Return Submission: Cobia submit your returns while you relax. Each year they will file your annual returns to Companies House, your Corporation Tax return and Quarterly VAT returns, making sure everything is filed on time.

Accountancy Advice: You can take advantage with getting advice from the very beginning - on company structure, dividend management, VAT, tax efficiency, payroll, bookkeeping and expenses.

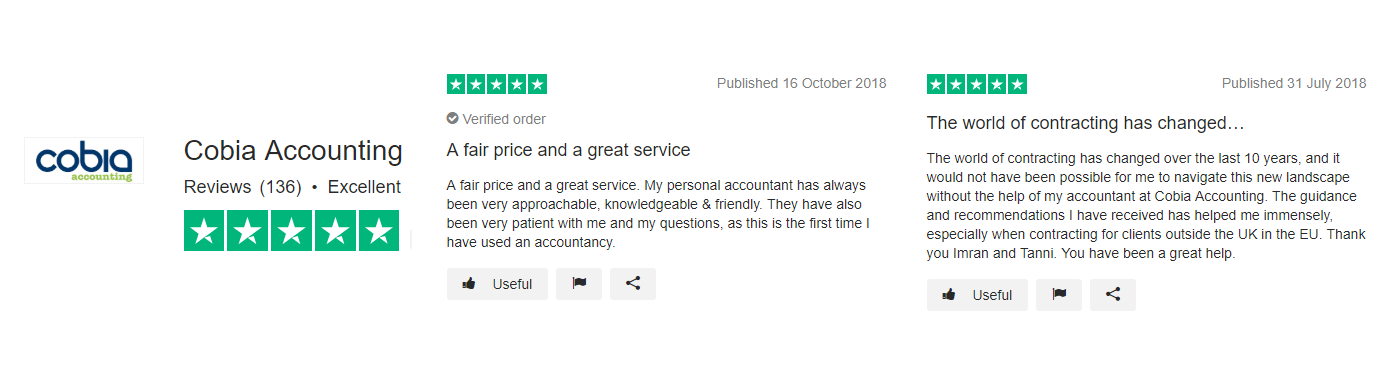

Trust Pilot Rated Excellent: – Read the reviews below:

For a fixed monthly fee, Cobia will take care of all your accounting needs, including:

Accounting Software: Cobia provide, for free, the accounting software from Xero. The system can be connected to your bank account to allow all transactions to be uploaded in real time, as you make them.

Bookkeeping: All transactions need accounting for in the correct categories so they are ready for your annual account submissions or quarterly VAT returns.

Annual Return Submission: Cobia submit your returns while you relax. Each year they will file your annual returns to Companies House, your Corporation Tax return and Quarterly VAT returns, making sure everything is filed on time.

Accountancy Advice: You can take advantage with getting advice from the very beginning - on company structure, dividend management, VAT, tax efficiency, payroll, bookkeeping and expenses.

Trust Pilot Rated Excellent: – Read the reviews below:

Accounting Packages

Annual Returns Service

Everything to keep your business compliant

£49 / month

• Free Market Leading Accounting Software

• Annual Accounts - Preparation and Submission to Companies House

• Corporation Tax - Calculation and Submission to HMRC

• Making Tax Digital for VAT Ready

Everything to keep your business compliant

£49 / month

• Free Market Leading Accounting Software

• Annual Accounts - Preparation and Submission to Companies House

• Corporation Tax - Calculation and Submission to HMRC

• Making Tax Digital for VAT Ready

Annual Returns + A Dedicated Accountant

For those with little accounting knowledge

£99 / month

All features of the Annual Returns Service package plus:

• Your Own Personal Accountant (unlimited access for tax advice & more)

• Quarterly VAT Returns

• Dividend Management

• PAYE Registration

• Directors & Employees Monthly Payroll (up to 2)

For those with little accounting knowledge

£99 / month

All features of the Annual Returns Service package plus:

• Your Own Personal Accountant (unlimited access for tax advice & more)

• Quarterly VAT Returns

• Dividend Management

• PAYE Registration

• Directors & Employees Monthly Payroll (up to 2)

All Inclusive

Complete accounting package with bookkeeping

£149 / month

All features of annual returns service with your accountant plus:

• Directors & Employees Monthly Payroll (up to 10)

• References for VISAs, property, employment and more

• Completion of quarterly management accounts

• Registered office address

• Customer Invoicing

• All-inclusive bookkeeping

Complete accounting package with bookkeeping

£149 / month

All features of annual returns service with your accountant plus:

• Directors & Employees Monthly Payroll (up to 10)

• References for VISAs, property, employment and more

• Completion of quarterly management accounts

• Registered office address

• Customer Invoicing

• All-inclusive bookkeeping